More than 2.6 million* mortgage borrowers have never experienced an environment where the Bank Rate has risen!

Even with the Bank Rate rise, there are still some decent deals on offer, possibly partly driven by lender appetite to compete for your business.

Ready to remortgage?

There are numerous reasons why you might decide that remortgaging is now desirable:

Home improvements – You may have had enough of holding back on your spending over the last few years and want, or need to undertake some of the bigger jobs around your home that you’ve put off. Also, you may recognise that in addition to creating a better living environment, it could add value to your property.

Securing a better deal – If you are coming towards the end of your deal period, you may be pleasantly surprised when you see what’s on offer, even though some lenders have upped their rates on selected deals. If it works out better for you, then you could even consider maintaining your current payments, which should help you along the way to paying off your mortgage sooner than expected.

Or you might already be sitting on your lender’s Standard Variable Rate (SVR), in which case you’ll be paying out a lot more for your loan. In some cases, there will be people who feel that they wouldn’t meet the stringent requirements to secure a new deal. That may be the case, but just as easily it may not. Additionally, certain things could now be working in your favour, such as your property being worth more.

Change the nature of your deal – You may want to look at taking out a fixed rate deal (where the interest rate remains the same across the loan deal period), should you be concerned about future rate rises.

Alternatively, you may decide that you want a different length of deal term – shorter, to give you greater flexibility and avoid the more onerous early repayment charges, or longer to help you to budget better across the next 5+ years.

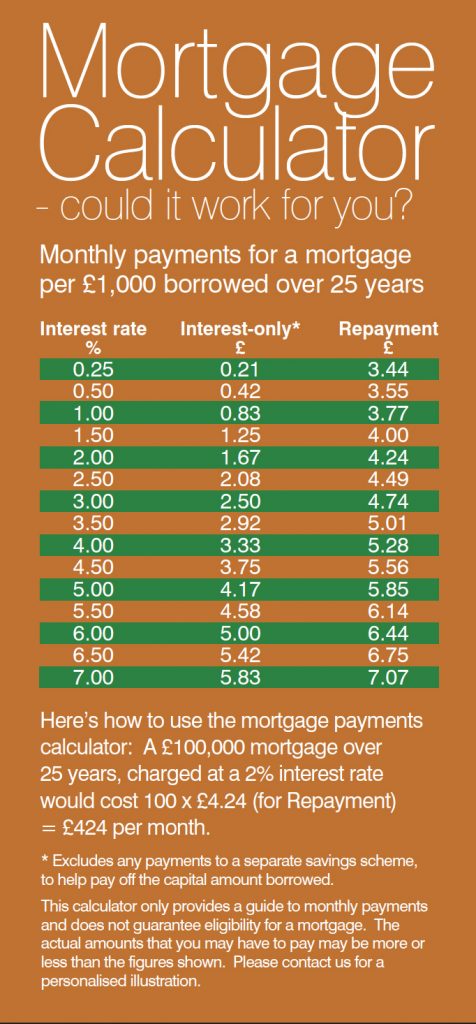

Or, you may currently sit on an ‘interest-only’ deal, and need to consider if the

discipline of a ‘repayment’ mortgage is now a better option – where you’ll be paying more, as part of the capital will be paid off as you go along. Check out the mortgage calculator to see how this may pan out.

But it’s simply too much hassle – You may not have a great desire to sift through the numerous lenders, their equally extensive range of product choices, and then try meet their affordability criteria.

That’s where we can help, as we can hold your hand through this process, and hopefully make it easier for you.

You may have to pay an early repayment charge to your existing lender if you remortgage.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Our broker fee is £395, payable should you ask us to arrange your mortgage, payable on application. This fee will be fully refunded if the mortgage application is declined and we are not able to source a suitable alternative lender.